RIO Press Articles |

| Globe Asia - Jun 2011 |

| Globe Asia - Currency Wars Nov 2010 |

| Player Magazine - Born Trader 2009 |

RIO Charity and Sponsorship |

| RIO Sponsors Anza Ball 2025 |

| RIO Sponsors FUFGT 2025 |

| RIO Sponsors German Open Cup 2025 |

| RIO Sponsors PHGT 2024 |

| RIO Sponsors JSAS Ball Nov 2024 |

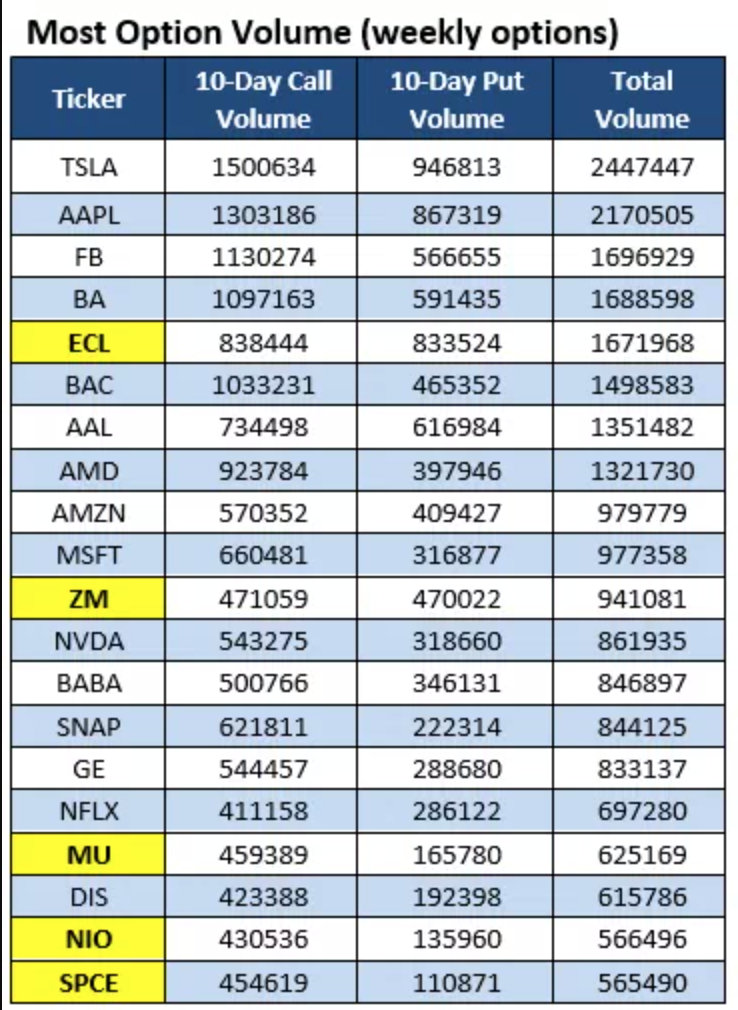

Calls Skyrocket on Virgin GalacticListed below are 20 stocks that have attracted the highest weekly options volume over the last 10 trading days thanks to data courtesy of Schaeffer's Senior Quantitative Analyst Rocky White -- who also highlighted new entrants in yellow. Standing out this week is Virgin Galactic Holdings Inc (NYSE:SPCE), a company that investors have kept a close eye on after billionaire Richard Branson's Virgin Group announced earlier this month a potential sale of up to 12.5 million shares of the company via Credit Suisse. Below, we'll take a closer look at the options activity surrounding SPCE and see how its been performing on the charts lately.

Most Active Options June 8 2020

Looking at White's data, over the past 10 days, 454,619 calls and 110,871 puts have exchanged hands. It looks like calls have been especially popular of late, per SPCE's 50-day call/put volume ratio of 3.16 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX). Today's trading leans bullish too, with 140,000 calls across the tape so far, double the intraday average. The weekly 6/12 17-strike call is most popular, with new positions being opened here. Last time we checked in on SPCE, the stock was in rally mode after a brief dip below the $10 level. Since then, the stock has lost steam after several run-ins with the $18 and $21 regions, though the 150-day moving average has moved in as solid support during the last couple of months. Today, SPCE is surging, up 8.4% at $17.14, at last check. Lastly, it's worth noting that short sellers are making ripples. Short interest is up 25.2% in the last two reporting periods, representing a staggering 46.6% of the stock's available float. In other words, it would take almost two days to buy back these pessimistic positions, at SPCE's average pace of trading.

|